The Somewhat Confident but Confused Open Enrollment Consumer

By Clive Riddle, November 4, 2016

This November, many consumers across the country are voting on more than a President, Congressmen and a hot mess of ballot propositions. They are also voting on their health insurance coverage for 2017. And many consumers may be more befuddled about choosing their health plan than their choices at the ballot box.

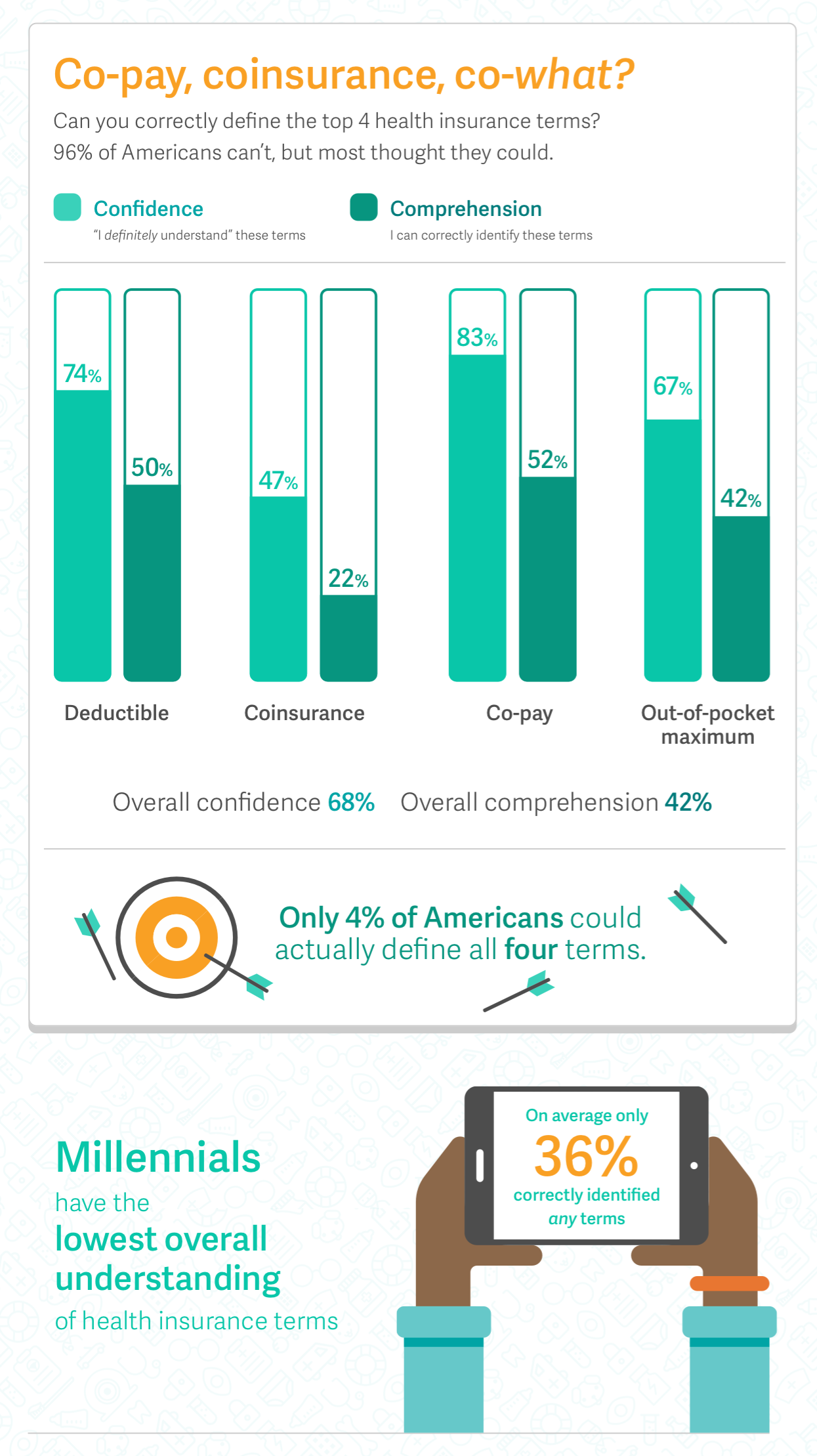

PolicyGenius has just released their Health Insurance Literacy Survey that “reveals 2017 open enrollment shoppers are overconfident in health insurance knowledge and under prepared to select a new plan.” Here’s an excpert from the infographic PolicyGenius provided on their findings:

Here’s additional PolicyGenius findings from the survey:

- There was 22% gap between women’s self-rated confidence in their knowledge of insurance terms and their actual comprehension, compared with a 29% gap for men.

- Millennials had a 29% gap between their confidence and comprehension.

- 72% of those with non-employer-provided health insurance policies plan to shop on the open marketplace for coverage this year.

- Most insured Americans are satisfied with their current plan, at 70% of total respondents

- People who used their health insurance 2-3 times in the past year are 12% more likely to be satisfied with their plan than those who used it just once

- Millennials are most likely to be satisfied with their health insurance plan, at 77%.

- There is no variation in plan satisfaction between those who have individual insurance versus employer-provided insurance.

- More than half of respondents aren’t very confident in their ability to choose the best health insurance plan for their needs.

- Only one-third of women overall are “very confident” in their ability to choose the best health insurance plan for their needs.

- The two groups that showed the highest confidence in their ability to choose the best plan were men at 58% and millennials at 43%.

- The survey found higher confidence levels in men over women (12% difference) and younger vs older respondents (millennials were most confident at 43%, 10% more than ages 45-55) in their ability to choose the best plan.

Sticking with the confusion theme, Walgreens has just released results of a survey of 1,000 Medicare Part D beneficiaries in advance of the Medicare open enrollment. Here’s what they found:

- 34% aren’t taking time to review their prescription drug plan prior to renewing it

- 19% don’t have a good understanding of their plan

- 22% look at just one component, checking, for example, to see if their own medications are covered, yet not looking at any other important considerations

- 21% falsely believes that all pharmacies charge the same copay

- 33% don’t know they can switch pharmacies outside of the enrollment period, at any time of year.

- 30% said copay costs are the most important factor, followed by pharmacy location (18%) and the opportunity for one-stop shopping (18 percent).

Post a Comment By

Post a Comment By  Riddle, Clive |

Riddle, Clive |  Friday, November 4, 2016 at 10:19AM tagged

Friday, November 4, 2016 at 10:19AM tagged  Consumers|

Consumers|  health plans

health plans

Reader Comments